Prelude

Hint: we’re going way further than Moon🌙 Thus, Rejoice! (..) for we’ve been pushing lots and lots of updates, for the past few years, as described on our Wizardous Twitter🐦 profile (tweet, tweet!)

To put things into a proper perspective, there are now well over 30TB of LIVE programming session stored by Google.

To put things into a proper perspective, there are now well over 30TB of LIVE programming session stored by Google.

Indeed, almost each and every single design rationale has been described to you on hourly basis, while being implemented LIVE on YouTube.

(..) No roadmaps. Just one aim – the very first 100% decentralized operating system with both best possible user experience and security (..)

In the meantime, since the early 2017, a multitude of sub-projects were brought into life, including, but not limited to:

- Research regarding incentivized data exchange. That’s extremely important for humanity🌎 Since, we are so much in need of truly decentralized data exchange and storage. Nodes shall be incentivized through cryptocurrency in a fully decentralized manner as well. Check-out the most recent, groundbreaking, peer-reviewed research paper, by Wizards🧙🧙♀️published by Springer Nature, now available Open Access🕊️ Download it from right over here and Rejoice! For it is Wizards who came up with the very first crypto-incentivized Sybil-proof data exchange apparatus for any kind of computer networks (no topology constraints)! Now, already available as part of ⋮⋮⋮ GRIDNET OS.

(..) Implications? Think of YouTube-like, Twitter-like and Facebook-like UI dApps running on top of ⋮⋮⋮ (..) Meaning no CEO could ever ban your profile just because he felt like it (being good papa of the entire World🌎, yeah right). Well, that’s not the World🌎 we, Wizards want to be living in, so we code and we deliver. Now, how about you?

- Research regarding employment of decentralized state-machines in any kind of cyber physical systems. Recent research paper published by Future Generation Computer System (Elsevier) available right here

- Research regarding employment of decentralized state-machines in power industry – we were the first to come up with the first, fully decentralized architecture for the power industry, with research results published at one of the most prestigious conferences in the world. The research paper itself is available right here (IEEE).

- a new programming language #GridScript to empower UI dApps and what people used to call ‘Smart Contracts’

- a new, user friendly approach to Non Fungible Tokens (NFTs). Why NFTs are so ‘special’ in the realm of Ethereum? That’s because Ethereum was never designed to cope with such a concept. Meaning? There’s no concept of a file in Ethereum. Yeah, really. No concept file permissions either. Let alone file-ownership.

- In ⋮⋮⋮ GRIDNET OS , on the other hand, one may execute Linux-compatible commands such as SETFACL and CHOWN, to set ownership of any file, with ease. Then, going further (..) oh blesses be the paths of decentralization!🕊️ (..) there are special utilities created to accommodate NFT-community such as SETMETA and GETMETA, which associate meta-data, including 1-to-1 Legal attributes with any file. One may SSH over to test.gridnet.org and see man-pages of these commands and test these through for oneself. There’s a separate, dedicated article regarding these functionalities on its way In short, the concepts which are cumbersome to execute on other platforms, here these will feel very natural. You will have galleries and museums implemented as actual folders within the decentralized operating system. And then.. VR-enabled UI applications taking use of these running within of a web-browser. Everything done the proper, the Wizardous kind of a way.

- an in-UI Web-GL powered Terminal UI dApp

- new cryptography constructs extending Botan crypto-library (needed to accommodate the desired user experience, we’re talking about both signatures and encryption with Curve25519 specifically)

- decentralized Remote Terminal Services (aided by the overall unique Wizardous software architecture where we’ve got things happening within a remote terminal, then by the-end, to be authorized to the entire network after scanning a single QR Code and holding a fancy Virtual Fingerprint Sensor for a few seconds).

- a multi-GPU mining sub-system

- Core-intrinsic web and web-socket’ server

- a decentralized User Interface (powered by WebGL, HTML, CSS and other technologies)

- an anonymous web-browser UI dApp (where one may customize the looks of remote websites and stuff). A web-browser within of a native web-browser effectively mitigating all of the Chromium’s CORS policies..

- an anonymous, crypto-incentivized reverse CORS proxy apparatus

- Access Control Lists-based file permissions (with Linux-compatible SETFACL, CHOWN etc. commands)

- AI and computer vision aided mobile apps for both iOS and Android

- decentralized, crypto incentivized file storage

- decentralized, crypto incentivized Web-RTC Swarms (note that there’s been nothing like it, no tech around which would allow for WebRTC traffic without centralized servers taking care of signaling, let alone making them crypto-incentivized).

- various UI dApps (including collaborative ones for decentralized P2P HD video, streaming , audio transmissions)

- lots more (..) including upcoming Decentralized Exchange implemented as an UI dApp, decentralized YouTube and way more.

All without a need to to install anything on users’ computers. It all simply works within a web-browser.. All without any kind of crowd-funding ever having taken place.

Great. Looks crazy HOT🔥 “But Hey!”.. (there’s always a ‘but‘ , and there’s always a ‘hey‘, is there not ).

How about the.. Basics ? How about getting to know the .. ‘TOKENOMICS‘?

Tokenomics, what about it?

Nowadays, lots of folks are like:

“DUDE, I just need to know whether to put my money into it (..) coz I want to get more“

more more more (..) And indeed that’s the very point! Now, lets get down to Basics. Every respectful project commits a ‘Whitepaper‘ with dozens (or way more) pages filled with ‘tokonomics‘, photos of money hungry ex-CEOs (watch out they as they may want to eat you alive) and promises of taking you to the Moon🌚 (she’s looking Good.. no.. she’s looking HOT🔥), a project collects money and then… we all know how it usually goes.. down the road.

As you probably do well know, we have been after after technology.

(..) ground-breaking new ideas (..) new possibilities (..) passion for things. With everything designed from the ground up, with their creations so high one can barely see a roof-top.. or can he not?

(..) Wizards🧙🧙♀️ (..) they come from the lands of bits and bytes the 0s and 1s (..)

“(..) Right. Seemingly, they are not so much about ‘numbers’, are they ? as none have been published so far(..) 🤔

Up Until Today!😊 (..) as like it or not.. Tokonomics are very important indeed.

Tech aside, economy is the kind of a thing which allows for your own personal wallet to grow, by collecting returns from your investments (time or money).

Yet, for this, when it comes to a “cryptocurrency-project” three things need to hold true.

- The project needs to be ‘good enough’ (now, that’s certainly obvious in case of ⋮⋮⋮ GRIDNET OS, isn’t it?)

- You would need to invest into it (now if you’ve got good prospects about the returns.. then it’s called an Opportunity)

- The Tokenomics💰 need to be rational and uphold technical aspirations of the project.

As for whether ⋮⋮⋮ GRIDNET OS is a ‘good project’,- you already know it. Some would prefer to stick with Ethereum or maybe even Bitcoin and that’s the beauty of free-will🕊️ We won’t be getting much into point 2) either, at least over here, as there’s to be a separate announcement and invitation in regards the upcoming fundraising campaign. Here we are about point 3 solely.

Now, grab a cup of coffee, if you haven’t already (if you haven’t and are still reading this then it must be a Good Project, indeed!) or imagine scents from the Old Wizard🧙’s cyber smoke pipe coming up your way..

Monetary Policies

Monetary policies and accounting, together with technology, are what allowed modern civilizations to blossom. Systems such as these arose independently in China, Egypt and Mesoamerica, with the oldest records stemming back from ancient Sumerian civilization in modern-day Iraq. Rejoice! As we’ve found a tablet that recorded a transaction of.. five goats.

This tablet has an account in Sumerian cuneiform describing the receipt of oxen

Now, we use paper no more, we prefer decentralized state-machines or ‘blockchains’. Sure! While some of us have already Moved On (oh blessed be thee, believers in the Wizardous Holy Tome!) .. some are still stuck in the paper era or even worse, the era of centralized governments.

Going back to Tokenomics. Investors look at these data and decide .. “is my money worth it? (..) or.. am I too loose (..)” ..dozens of visions spinning through each and every Inventor‘s head. As each and every investor is after finding the Love of His Life❤️

(..) relax! No obligations needed.

Are you looking at The Next New Thing? You definitely, surely are!

While a project might be a crazy cool geek’s toy, if tokonomics are broken, – nobody would invest. Which means either a slowly or rapidly dying project and before you know it.. the moment is gone🎵

(..) 🎵 and we certainly do not want our moment to be gone, do we?🎵

On the other hand, while Tokenomics might be seemingly Great or at least rational according to some fundamental analysis (say a low capped project) , – how about the usability?

Have you taken the entire picture into account?

See, crypto-realm is no more (solely) about crypto-payments. In ⋮⋮⋮ GRIDNET OS it’s like 0.001% of the functionality set introduced on day-1.

See, a project might had promised you a decentralized computer.

Folks behind it might have said that it would reward for data exchange.. but see,- its Tokenomics turned out to be ‘low-capped’. If the project ever gained popularity in the first place, its system intrinsic crypto-asset would be way too expensive for a normal daily use, not to mention rewarding peers for data exchange on a per-byte basis.

Here, one may recall IOTA’s (Irresponsible Ones Take Advantage, let us never forget!) enormously huge supply politics. If they ever got anything right, it surely was understanding that for rewarding such miniscule tasks as data-retransmissions,- a large monetary supply with high-precision denomination was needed. Anyhow, let IOTA R.I.P

Wait, a sec.. so the project at hand is not only about cryptocurrency, but about many.. no.. wait a sec.. a zillion of other things?

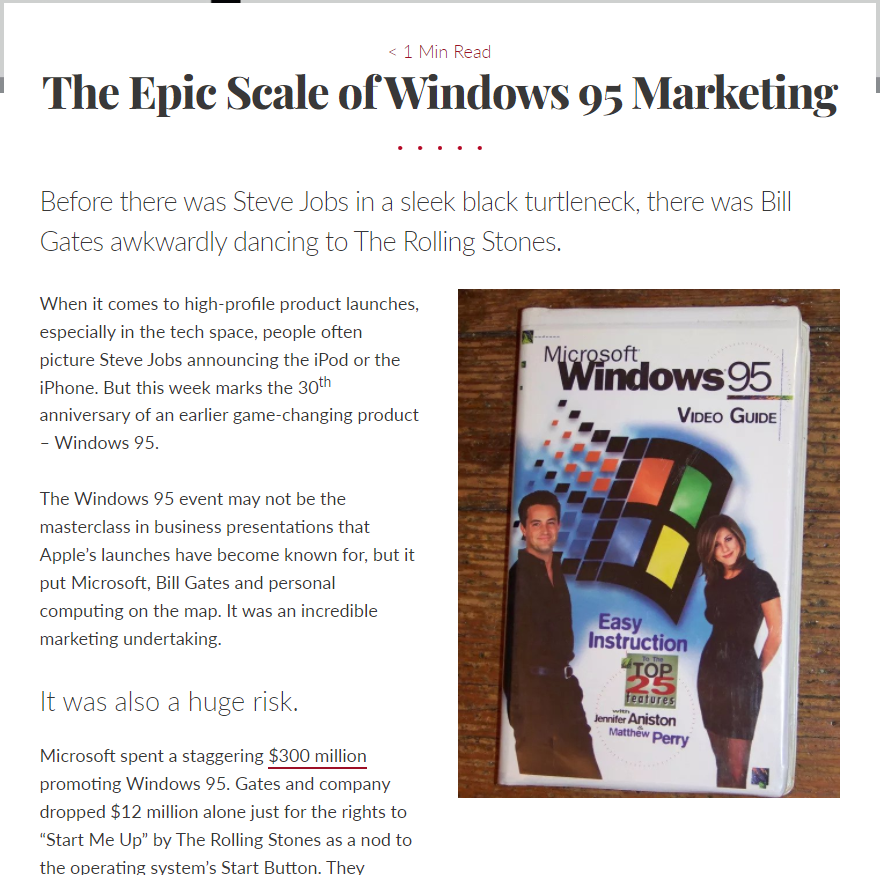

Relax.. feel the Wizardous scents coming up your way.. we’re talking about true.. decentralized operating system experience.. where literally anything could happen. Like back in the Windows 3.11 time when all of the sudden a guy named Bill, came up with the idea of drawing windows on his screen (..)

Wait. hold on a sec(..)okay! Under the assumption they can really pull it off (..) who’s covering the development costs? Should we put our faiths entirely in DAO-based assets’ assignment and voting? Is the project to be developed and maintained for next 1.. 2 years? or maybe 200+ years? In any case, we need to cover the costs and assure progress.

We need to afford best developers money can buy. We are about true Wizards🧙🧙♀️ We’ve been after and offered nothing less since the early 2017 on our YouTube LIVE-streams.

Wizards🧙🧙♀️ (..) armed with guns of computer science and cryptography no mercy for centralization have they got .

Let us settle our thoughts and think about two main pillars of the current crypto realm.

As you might be already well aware of, there have been two camps, for the most of it, each with their own Truths:

- Bitcoin Camp – these fellas, they cherish what they’ve got and we all know – they haven’t got much. Bitcoin can send and receive assets and that’s about it. What they’ve surely got are clear supply rules. Deflationary monetary economy. Beauty lies in simplicity. There’s no arguing about that. But what about a sexy, smart women? She’s not that simple (lots of atoms) even still,- you want her (so bad)

- Ethereum Camp – that was supposed to be the world-wide decentralized computer everyone was waiting for. Deflationary money policy. No hard-caps. Truth is no one knows its economy and surely no one knows what its economy is going to be tomorrow. It all depends on how Vitalik sees fits.

That only demonstrates the power of technology. As long as everything works. Everything is FINE. As long as expectations are fulfilled, people do not care about the details. They do not care whether Ethereum’s monetary decisions are centralized or not. It works? It’s fine. There’s a scent of decentralisation in the mix and then it’s all good. It’s good enough. That’s until people get some sort of wakeup call.

What we need to learn from it; is that peoples’ hunger for more than what Bitcoin is – allowed Ethereum to flourish into the biggest cryptocurrency project right next to it. Ethereum is way more than Bitcoin. It has an enormous problem though. What is it? Its technology is rooted back in the days when Bitcoin was conceived. Ethereum fellas learned from Bitocin, they did an amazing job; but still they haven’t departed far enough to withstand the glory of ⋮⋮⋮ GRIDNET OS, did they? The possibilities it allows for.

Let us get back to Tokenomics.

(..) It turns out there’s no point to having a hard-capped monetary policy (..) a hard-capped monetary policy may be both risky and dangerous if the Project is supposed to support worldwide system at both macro and micro scales (..) What the Tokenomics (or any other monetary policy) need to assure, though, are stability and predictability.

Otherwise people wouldn’t know what they could afford the next day and planning wouldn’t be feasible.

To cite Ben Edgington for Decrypt:

“Bitcoiners are obsessed with this. The defining property of their blockchain is that it has fixed issuance—this is their thing. For them, it’s all about money supply. In Ethereum it’s all about getting stuff done.”

In ⋮⋮⋮ GRIDNET, it’s about getting stuff done as well. (..) still (…) in ⋮⋮⋮ GRIDNET OS (..) what has already been done and is to be done (…) is significantly more than in all the previous blockchain projects combined. Let us Rejoice!

Let’s cut the cake..

Recently, we’ve rewritten portions of ⋮⋮⋮ GRIDNET OS to allow for high-precision computations (including extremely precise 256-bit floating-point numbers! Recall that at the same time Ethereum doesn’t even support single point 32-bit based floating point arithmetic’s).

The changes that we’ve made also allowed for extremely high-fidelity Tokenomics. Let us take a look, shall we?

Note: the amount of coins to be offered to the public, as depicted below, is to be sold across two separate rounds of public offerings. The details in regard to these are yet to be published.

The name of the asset is GRIDNET Coin (GNC). The currency has a high-precision denomination. Namely,

- 1 GRIDNET Coin (GNC) = 1*10^18 GRIDNET Basic Units or GRIDNET Atto Coins

so in ‘lame notation’ that would be equal to:

- 1 GNC = 100000000000000000 GBUs/Atto Coins

Maximum Total Initial Supply: 952 Million GNC

During fundraising,

- Expected Per Token (GNC) Price: 0.3 USD

Let us now see what the possible outcomes of the upcoming fundraising campaign are, and how these could affect the initial total supply. In any keys always do keep in mind that whatever the outcome of fundraising campaign, ‘the product’ is already ready for the most of it.

Additionally, in any case, 30% of the initial total supply comprises The Wizardous Fund, with the minimum of 42 million GNC.

The charts to follow are in millions of United-State Dollars and are fixed at the initial GNC price of 0.3 USD. That’s for better visualisation. Thus, the charts do not attempt to reflect or estimate expected fluctuations in the price of GNC.

Best-case scenario (all assets sold out)

- GNC worth 85 million USD goes to The Wizardous Fund.

- GNC worth 200 million USD is distributed to investors.

Initial total supply thus ends up to be equal to 285 million USD.

Now, in terms of GNC Tokenomics, in according to the above depicted best-case scenario:

- ~952.38 million GNC Total Supply (best-case scenario).

Mid-case scenario (some sold and some not)

Other things held constant, the unsold part is burned.

As you may see, the Wizardous Fund still comprises 30% of the initial total tokens’ supply.

The Impossible Scenario (nobody invested)

The Wizardous fund ends up with 42 million GNC worth 12.6 million USD as per the Coin Offering price. The rest of the total supply goes to investors (i.e. worth at least 0 , literally zero USD).

As time goes by

Every 10 minutes a ‘key-block’ is released giving a reward of 360 GNC to a successful ‘miner’. We won’t be getting much into the consensus protocol over here, let it suffice to say that we’re dealing with a variation of Bitcoin NG’s protocol where rewards are shared across consecutive miners and the frequency of data-blocks (those containing the actual ‘transactions’) is uncapped at all. The system employs additional cryptocurrency ERG, which is to offset for variation in the price of GNC, and is to be used to describe transaction fees (similarly to Ethereum’s ‘gas’).

Quick calculations show us that, that results in issuance of 19000000 each year, resulting in a maximum inflation cap of 2%. That is, if we arrive at the Best-Case scenario in terms of the fundraising campaign. The effective inflation rate can then further be lowered through taxes set and managed through DAO. The issuance of new assets is also controlled by the decentralized consensus.

Now, by default,

- each transaction is taxed 0.05%

- rewards for miners are taxed at 5%

‘taxes’ travel to the Wizardous Fund, managed through our Decentralized Autonomous Organization (DAO).

Note: The Project can withstand any of the above scenarios since ‘the Product‘ is already ready and available to the Public🕊️. The Decentralized Web-UI is to be made available within weeks to follow.

Fundraising Time-frame

The offering is expected to last for a maximum time period of 365 days (though it may end within a couple of hours), starting from the day The Fundraising begins (yet to be announced). As already said, we’re likely to be dividing public fundraising into two stages.

During that time, Test-Net is to remain operational and with transactions considered as final.

Thus, all transactions made in Test-Net would have an effect on Live-Net. That is, as seen from the moment in which Test-Net transitions into a Live-Net.

Note that, in the meantime, intermediary transactions might fail, be reverted etc, at our discretion (e.x. due to a ‘hack’ or ‘vulnerability’, through the ‘Overwatch’ functionality, see Constitution within the Wizardous Tome). The ‘Overwatch’ functionality is to be disabled as soon as Network transitions into a Live-Net.

Anyone is to be able to spawn a new ⋮⋮⋮ GRIDNET Core node and earn cryptocurrency, which would also have permanent effect,- yet again, once network Transitions into a Live-Net.

In other words, once Test-Net transitions into a Live-Net all Identity Tokens and accounts’ balances would be imported into Live-Net by means of a Genesis Block, i.e. stored within the Genesis block to have thus a persistent, permanent effect.

Once either the time period of 365 days expires, or the maximum fund-raising cap is reached, the remaining unsold tokens would be burned, i.e. destroyed.

As time goes by, we’ll be seeing these proportions change:

System State-Domains

⋮⋮⋮ GRIDNET OS has a file system. Much like a file system in a computer you’re using right now. With one huge difference. It is fully decentralized. It also embeds file-permission mechanics much like your home operating system. User have ‘accounts’ still here we call them State-Domains. There are also special, system-level state domains. Since the system is already operational, we’ll be using these state-domains, with associated initial balances, to issue assets to investors as they participate in the fundraising campaign.

As investors buy assets, these would be transferrable right away📧

These special State-Domains are available right now, in the current version of the Test-Net. You may simply ‘CD’ into them over SSH right now and already keep track of how their associated balances change. These are their associated “Friendly IDs”:

- “ICOFund” – Contains around 70% of the best-case scenario total supply.

Assets to Investors are issued from this very State-Domain.

- “TheFund” – initially contains 42 million GNC. Should more than 92 million be sold to investors (and thus the initial total supply exceeds 140 million GNC). This state-domain would be awarded 30% of the excess. Managed both through DAO voting and Wizards. Assets to be spent at Wizards’ discretion (no DAO voting required). To be used to make Wizards a living, ascertain them some entertainment, hire developers, promotion, etc.

- “System” – contains system-related data files.

- “Treasury” – receives 0.05% from any transaction done within the system and 5% from miners’ rewards. Nobody likes taxes. For regular users, the system doesn’t take 5%, it doesn’t take 3%.. not even a 1%. All it takes is 0.05% from the value of any on the-chain transition or miner’s reward. To be managed autonomously, through the Decentralized Consensus. DAO voting required i.e not to be spent at the Wizards’ sole discretion. Used for development and any other purpose, DAO voting should deem as valid. Its main purpose is to ascertain safety and thriving of the Wizardous Project Till the End of Time. Note that the beauty of decentralization lies in the fact that the very existence or the value of this very tax ..would be managed by the decentralized community…

Thus, in any case, the initial total supply shalt be equal to the sum of the amounts of assets stored within both the Coin Offering Fund and the Wizardous Fund.

Now, before you even think that aiming for ~~$200 Million USD is ‘a lot’..

(..) 300 million USD on marking alone. And that was back in the early 90s. Lesson to be learned? Think out-of-the box or the World🌎 would live you behind.