Introduction

In the annals of human history, few innovations have challenged our understanding of value and currency as profoundly as cryptocurrencies. Bitcoin, the pioneer of this digital frontier, erupted onto the global stage in 2009, promising a decentralised alternative to traditional financial systems. Yet, as we stand at the precipice of a new technological era, we must look beyond Bitcoin to grasp the true potential of cryptocurrencies in shaping human progress. Much like the ancient Lydians, who first minted standardised metal coins around 600 BCE, we find ourselves at a pivotal moment in the evolution of money. Just as that innovation transformed trade and societal structures, cryptocurrencies stand poised to revolutionise not just finance, but the very fabric of human cooperation and advancement.

This article posits that as humanity evolves, shedding the psychological constraints that bind us to familiar systems, we will inevitably gravitate towards cryptocurrencies backed by functional technology. These digital assets represent more than mere stores of value; they are the building blocks of a new decentralised infrastructure that could underpin scientific progress, protect free speech, and enable truly democratic decision-making on a global scale. As we delve into this complex landscape, we will draw upon the wisdom of economic luminaries such as Friedrich Hayek, who presciently wrote in his 1976 work “Denationalisation of Money” about the potential for private currencies to compete with government-issued money. We will also channel the spirit of inquiry exemplified by Yuval Noah Harari, examining how our collective beliefs shape our economic realities and how technology might alter the course of human history.

From the golden fields of Lydia to the digital mines of the blockchain, the story of currency is the story of human progress. As we embark on this exploration, we invite you to challenge your preconceptions about value, technology, and the future of human cooperation. For in understanding the true potential of cryptocurrencies, we may glimpse the next great leap in our species’ journey.

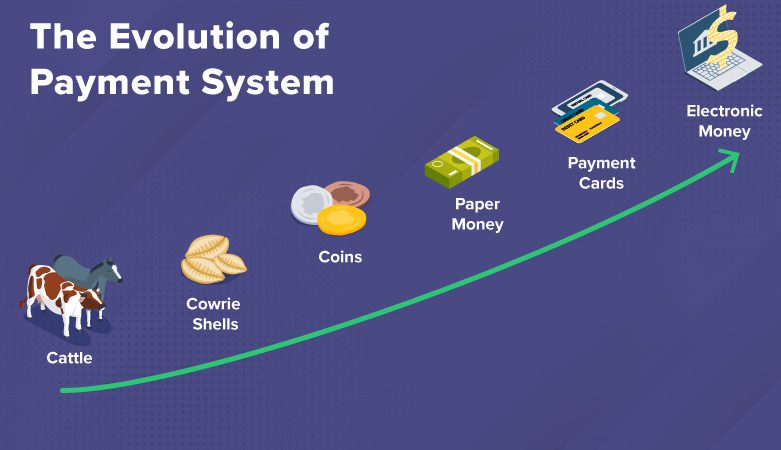

The Evolution of Value

The concept of value has been a cornerstone of human civilisation since time immemorial. From the cowrie shells of ancient China to the gold standard of the 20th century, our species has continually redefined what constitutes worth. This evolution is not merely an economic phenomenon, but a reflection of our collective consciousness and technological progress.

In his seminal work “The Wealth of Nations,” Adam Smith posited that value derives from labor, stating, “The real price of everything… is the toil and trouble of acquiring it.” This labor theory of value dominated economic thought for generations. However, as our understanding of economics matured, so too did our conception of value. The marginalise revolution of the late 19th century, led by economists like William Stanley Jevons and Carl Menger, shifted focus to subjective valuation. Menger argued that value is not inherent in objects, but in the minds of individuals. This principle underpins modern cryptocurrency markets, where the perceived utility and scarcity of digital assets drive their worth. Yet, the story of value is not just one of academic theories. Throughout history, necessity and circumstance have often dictated what humans deem valuable. During World War II, cigarettes became a de facto currency in prisoner-of-war camps, demonstrating that value can arise from collective agreement, even in the absence of state backing or intrinsic worth.

This malleability of value is perhaps best encapsulated by Yuval Noah Harari’s concept of “shared fictions” – the idea that much of human progress stems from our ability to collectively believe in abstract concepts. Money, in all its forms, is perhaps the most powerful shared fiction of all. As we transition into the digital age, our notions of value are once again being challenged. Cryptocurrencies represent a new frontier, where value is derived not from physical scarcity or state decree, but from mathematical certainty and network effects. Bitcoin, with its fixed supply of 21 million coins, echoes the scarcity principle that once made gold valuable. Yet, it transcends physical limitations, being infinitely divisible and instantly transferable across the globe.

But as we will explore in subsequent sections of this article, the true value of cryptocurrencies may lie not in their ability to mimic traditional stores of value, but in their potential to facilitate entirely new forms of human cooperation and technological advancement.

The evolution of value, from tangible commodities to abstract digital assets, reflects humanity’s growing capacity for complex thought and technological innovation. As we stand on the brink of a new era, we must ask ourselves: What forms of value will drive human progress in the coming decades? And how might cryptocurrencies shape this next chapter in our economic history? In the words of economist Joseph Schumpeter, “The process of Creative Destruction is the essential fact about capitalism.” Perhaps cryptocurrencies are the latest manifestation of this process, destroying old concepts of value while creating new possibilities for human advancement.

Bitcoin: The First Step

In the aftermath of the 2008 financial crisis, as trust in traditional financial institutions wavered, a pseudonymous figure known as Satoshi Nakamoto introduced Bitcoin to the world. This digital currency, built on blockchain technology, represented more than just a new form of money; it was a paradigm shift in how we conceptualise trust, value, and financial sovereignty.

Bitcoin’s most revolutionary feature lies in its limited supply – a maximum of 21 million coins that will ever exist. This scarcity principle echoes the economic theories of Ludwig von Mises, who argued that sound money must be scarce to maintain its value. In his work “The Theory of Money and Credit,” Mises posited that the quantity of money has a profound impact on its purchasing power. Bitcoin, with its predetermined emission rate, offers a stark contrast to the inflationary tendencies of fiat currencies. However, Bitcoin’s value proposition extends beyond mere scarcity. Its decentralised nature challenges the Westphalian model of state-controlled currency that has dominated since the Treaty of Westphalia in 1648. As Friedrich Hayek envisioned in his work on the denationalisation of money, Bitcoin represents a private currency competing with government-issued money on a global scale. Critics often argue that Bitcoin lacks intrinsic value, echoing concerns raised by John Maynard Keynes about the gold standard being a “barbarous relic.” Yet, this criticism fails to recognise the underlying work and utility that give Bitcoin its value. The energy expended in mining, the complex cryptography ensuring its security, and the growing network of users and businesses relying on it for value transfer all contribute to its worth.

Moreover, Bitcoin’s first-mover advantage in the cryptocurrency space mirrors the historical dominance of gold as a store of value. Just as gold’s perceived value was reinforced over millennia of human history, Bitcoin’s pioneering status has cemented its position in the collective psyche of the digital age. The rise of stablecoins like USDT, pegged to the value of the US dollar, further demonstrates the crypto ecosystem’s ability to cater to diverse financial needs. This development echoes the creation of paper money as representations of gold, showing how new forms of currency can emerge to serve specific purposes within a broader monetary system. However, as Yuval Noah Harari might observe, Bitcoin’s success is as much a product of collective belief as it is of technological innovation. The cryptocurrency’s value is sustained by a critical mass of users who have chosen to place their trust in a decentralised system rather than traditional financial institutions.

Yet, Bitcoin is not without its flaws. Its energy-intensive proof-of-work consensus mechanism has raised environmental concerns, and its limited transaction throughput poses scalability challenges. These issues remind us that while Bitcoin represented a crucial first step in the cryptocurrency revolution, it is unlikely to be the final word. As we look to the future, we must recognize Bitcoin’s role as a trailblazer, opening our minds to the possibilities of decentralised, digital currencies. However, we must also be prepared for the next wave of cryptocurrencies that may offer improved functionality, efficiency, and alignment with broader human needs.

In the words of economist Joseph Schumpeter, “The process of industrial mutation…incessantly revolutionises the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Bitcoin has initiated this process in the realm of money and value. The question that remains is: What new structures will arise from this creative destruction?

The Generational Divide – Old Guard vs. New Wave in Value Exchange

The debate surrounding cryptocurrencies as a legitimate means of value exchange reveals a fascinating generational and ideological divide in the world of finance. This schism highlights not just technological differences, but fundamental shifts in how value itself is perceived and transferred in the 21st century. Investors of the “old guard” typically adhere to traditional metrics of value, firmly rooted in centuries of economic theory and practice. As economist Benjamin Graham, often called the father of value investing, wrote in “The Intelligent Investor,” they seek “a favorable difference between price on the one hand and indicated or appraised value on the other.” For these investors, value is intrinsically tied to tangible assets, cash flows, and proven track records.

Their skepticism towards cryptocurrencies often stems from the apparent lack of these traditional value indicators. Warren Buffett, an icon of this old-school thinking, famously called Bitcoin “rat poison squared,” highlighting the absence of productive capacity or tangible output from cryptocurrency investments. This perspective is deeply ingrained in the philosophy that money should be a stable store of value, a reliable medium of exchange, and a consistent unit of account – qualities that the volatility of many cryptocurrencies seems to contradict. The old guard often emphasises the importance of centralised authority and regulation in maintaining financial stability. The decentralised nature of cryptocurrencies, while appealing to some, represents a significant risk factor for those accustomed to government-backed currencies and traditional financial institutions. In contrast, the “new wave” of investors approaches value exchange from a fundamentally different perspective. For them, the digital nature of cryptocurrencies is not a bug, but a feature. They see value not just in tangible assets, but in network effects, technological innovation, and the potential for disruptive change.

This new generation of investors, raised in the digital age, intuitively understands the concept of digital scarcity – a cornerstone of many cryptocurrencies’ value proposition. They draw parallels between Bitcoin’s limited supply and the scarcity of precious metals, but see additional value in the programmability and transferability of digital assets. Furthermore, the new wave places a premium on financial sovereignty and censorship resistance. In a world where digital privacy is increasingly scarce, the pseudo-anonymous nature of many cryptocurrencies is seen as a feature rather than a drawback. This aligns with a broader generational shift towards valuing personal autonomy and distrust of centralised authorities, as noted by sociologist Shoshana Zuboff in her work on surveillance capitalism. The new perspective also emphasises the potential for cryptocurrencies to serve as a hedge against inflation and government monetary policies. This view gained particular traction following the 2008 financial crisis and subsequent quantitative easing measures, which eroded trust in traditional financial systems. Cryptocurrency advocates often cite economist Friedrich Hayek’s arguments for the denationalisation of money as theoretical support for their position. Interestingly, the rise of decentralised finance (DeFi) platforms has begun to bridge this generational divide. These systems, which recreate traditional financial services on blockchain networks, offer a blend of the old and new. They provide familiar financial products like loans and interest-bearing accounts, but do so in a decentralised, algorithmically governed manner that appeals to the new wave of investors.

The evolution of stable-coins – cryptocurrencies pegged to traditional assets – also represents a convergence of old and new thinking. These digital assets aim to combine the stability valued by traditional investors with the technological advantages of cryptocurrencies. As we move forward, it’s crucial to recognise that neither perspective has a monopoly on truth. The old guard’s emphasis on intrinsic value and stability remains relevant, while the new wave’s focus on technological potential and financial innovation drives progress. The future of finance likely lies in a synthesis of these viewpoints, creating systems that are both stable and innovative, secure and flexible. The difference in thinking about proper means of value exchange reflects broader shifts in our society – from centralisation to decentralisation, from physical to digital, from institutional trust to algorithmic trust. As cryptocurrency ecosystems mature and traditional finance continues to evolve, we may see a gradual convergence of these perspectives, leading to a more nuanced and comprehensive understanding of value in the digital age.

The Intersection of Technology and Value

As we venture deeper into the digital age, the line between technology and value becomes increasingly blurred. Cryptocurrencies, far from being mere digital representations of money, are emerging as complex ecosystems where technological innovation and economic value creation are inextricably linked. This symbiosis between technology and value is not entirely new. As economist W. Brian Arthur noted in his work on the nature of technology, “Technology creates its own momentum and feeds on itself.” We see this principle at play in the cryptocurrency space, where each technological advancement creates new possibilities for value creation and transfer. The concept of “smart contracts,” first proposed by legal scholar and computer scientist Nick Szabo in the 1990s, has found its realization in blockchain platforms like Ethereum. These self-executing contracts with the terms of the agreement directly written into code represent a fusion of legal, financial, and technological innovation. They challenge our traditional notions of contract law and open up new avenues for autonomous, trust-less transactions. Moreover, the incentive structures built into cryptocurrency networks exemplify how technology can be used to align economic interests. The proof-of-work consensus mechanism used by Bitcoin, while energy-intensive, creates a robust security model by making it economically unfeasible to attack the network. This echoes the game theory principles outlined by John von Neumann and Oskar Morgenstern, showing how rational self-interest can be harnessed to maintain system integrity.

As we progress, we’re witnessing the emergence of cryptocurrencies that go beyond simple value transfer. Platforms like Polkadot and Cosmos are creating interoperable blockchain ecosystems, enabling seamless communication between different blockchain networks. This technological leap forward is akin to the development of the internet protocol, which allowed diverse computer networks to communicate, ultimately leading to the World Wide Web. The rise of decentralised finance (DeFi) platforms further illustrates the potential of this technology-value nexus. By recreating traditional financial services in a decentralised, open-source environment, DeFi is challenging the very foundations of our financial system. This echoes the disruptive potential that economist Joseph Schumpeter attributed to technological innovation in his theory of creative destruction.

However, as we embrace these technological advancements, we must also grapple with their implications. The anonymity and irreversibility of many cryptocurrency transactions pose challenges for regulatory compliance and consumer protection. As economist Hyman Minsky warned, “Stability breeds instability,” and the rapid innovation in this space may lead to unforeseen risks. Yet, it’s crucial to recognise that the value of cryptocurrencies extends beyond their technological features. As Yuval Noah Harari might observe, these digital assets are becoming new “shared fictions” that shape our economic reality. The collective belief in their utility and potential is as much a part of their value as the underlying technology. Looking ahead, we can anticipate that the most successful cryptocurrencies will be those that offer not just technological sophistication, but also clear utility and alignment with human needs.

Whether it’s facilitating micro-transactions in the Internet of Things, enabling new forms of democratic participation, or providing financial services to the unbanked, the future of cryptocurrencies lies in their ability to solve real-world problems. The intersection of technology and value in the cryptocurrency space is redefining our understanding of both concepts. As we continue to navigate this new terrain, we must remain mindful of both the opportunities and challenges it presents, always striving to harness these innovations for the greater benefit of humanity.

The Digital Native’s Investment Paradigm

In the rapidly evolving landscape of finance and technology, a new generation of investors is emerging – one that views cryptocurrencies not as abstract financial instruments, but as integral components of their daily digital lives. For these tech-savvy individuals, often referred to as “digital natives,” cryptocurrencies and blockchain projects represent a natural extension of their technologically immersive lifestyle.

Unlike previous generations who might spend their leisure time watching movies or sports, these young investors are more likely to be exploring decentralised applications (dApps), participating in online communities, or experimenting with emerging technologies. For them, the world of cryptocurrencies is not a distant, esoteric realm, but a tangible, accessible part of their everyday experience. This familiarity breeds a level of comfort and understanding that traditional investment vehicles often fail to provide. As media theorist Marshall McLuhan famously stated, “The medium is the message.” In this case, the medium of blockchain and cryptocurrencies resonates deeply with a generation raised on digital platforms and peer-to-peer networks. The accessibility of cryptocurrency investments is a key factor driving their appeal among young investors. Traditional financial markets often present significant barriers to entry – minimum investment requirements, complex paperwork, and sometimes even the need for accredited investor status. In contrast, anyone with an internet connection can create an account on a cryptocurrency exchange, whether centralised or decentralised, and begin investing in a matter of minutes or hours.

This democratization of investment opportunities aligns perfectly with the egalitarian ethos of the internet age. Moreover, the low entry barriers extend beyond just account creation. Many cryptocurrency projects allow investments of any size, enabling young investors to start small and gradually increase their exposure as they gain confidence and knowledge. This “learning by doing” approach resonates with the experiential learning style often preferred by digital natives. Crucially, these young investors don’t see their engagement with cryptocurrencies as mere speculation or betting. Instead, they view it as investing in concrete projects with tangible functionality and real-world applications. This perspective is fundamentally different from traditional views of cryptocurrency as a purely speculative asset class.

Many blockchain projects offer clear value propositions that are immediately understandable and relevant to this generation. Decentralised finance (DeFi) platforms provide accessible financial services without the need for traditional banks. Non-fungible tokens (NFTs) offer new ways to own and trade digital assets, resonating with a generation accustomed to virtual ownership. Decentralised social media platforms promise alternatives to current models fraught with privacy concerns and centralised control. The rapid development cycles in the cryptocurrency space also appeal to the instant-gratification mindset often attributed to younger generations. Unlike traditional investments that might take years to show significant returns or impact, many crypto projects go from concept to functional product in a matter of months. This allows young investors to see the tangible results of their investments relatively quickly, reinforcing their engagement and enthusiasm. Furthermore, the community aspect of many cryptocurrency projects aligns well with the social media-savvy nature of digital natives. Many young investors are not just passive participants but active community members, contributing ideas, testing new features, and even participating in governance through decentralised autonomous organisations (DAOs). This level of involvement creates a sense of ownership and belonging that traditional investments rarely offer.

It’s also worth noting that for many in this generation, the traditional financial system is associated with the 2008 financial crisis and its aftermath – events that occurred during their formative years. Cryptocurrencies, born in the wake of this crisis, represent to them a potential alternative to a system they view with skepticism. However, this enthusiasm doesn’t equate to naivety. Many young investors are acutely aware of the risks and volatility in the cryptocurrency market. They often approach their investments with a level of due diligence that belies stereotypes of youthful impulsiveness. They research projects’ technical foundations, assess their real-world applicability, and engage in community discussions before committing their funds. For a growing number of young, tech-savvy investors, cryptocurrencies represent more than just a new asset class. They embody a new paradigm of investment – one that is accessible, tangible, and deeply intertwined with their digital lives. As this generation’s economic influence grows, their perspective on cryptocurrencies as practical, innovative investments rather than speculative gambles may well become the dominant view in the financial world of tomorrow.

Decentralisation: A Necessity for Progress

As we advance into an increasingly interconnected world, the concept of decentralisation emerges not just as a technological innovation, but as a fundamental necessity for human progress. Cryptocurrencies, with their inherent decentralised nature, are at the forefront of this paradigm shift, offering solutions to some of the most pressing challenges of our time.

The philosopher Hannah Arendt once wrote, “Power corresponds to the human ability not just to act but to act in concert.” In the context of cryptocurrencies, this idea takes on new meaning. Decentralised systems distribute power among participants, creating resilient networks that are resistant to censorship and single points of failure. One of the most profound applications of this decentralised model is in the realm of voting systems. Traditional centralised voting mechanisms are vulnerable to manipulation and lack transparency. Blockchain-based voting systems, however, offer the potential for secure, verifiable, and tamper-resistant elections. This technology could revolutionise democratic processes, echoing the aspirations of political theorists like Robert Dahl, who emphasised the importance of effective participation and voting equality in his concept of polyarchy. Moreover, the need for secure, anonymous communication in the digital age has never been more apparent. As governments and corporations increasingly surveil online activities, cryptocurrencies and their underlying technologies offer a counterbalance. Zero-knowledge proofs and other cryptographic techniques enable private transactions and communications, preserving the right to privacy that Justice Louis Brandeis called “the most comprehensive of rights and the right most valued by civilised men.” The protection of ideas and innovation from centralised control is another crucial aspect of decentralisation. In his seminal work “The Open Society and Its Enemies,” philosopher Karl Popper argued for the importance of free thought and criticism in societal progress. Decentralised platforms built on cryptocurrency technologies can provide censorship-resistant spaces for the exchange of ideas, fostering innovation and protecting against the suppression of knowledge.

However, the path to decentralisation is not without challenges. As economist Ronald Coase noted in his work on transaction costs, there are often efficiency gains from centralisation. The challenge lies in creating decentralised systems that can match or exceed the efficiency of centralised alternatives while providing additional benefits of resilience and individual empowerment. Furthermore, the implementation of decentralised systems raises important questions about governance and accountability. While decentralisation can protect against certain forms of abuse, it also creates new challenges in coordinating collective action and resolving disputes. The ongoing experiments with decentralised autonomous organizations (DAOs) are attempts to address these issues, drawing inspiration from political science theories of collective action and self-governance. As we look to the future, the potential applications of decentralised technologies extend far beyond finance. From supply chain management to scientific research, decentralised systems could enable new forms of collaboration and data sharing. This aligns with the vision of internet pioneer Tim Berners-Lee, who has advocated for a decentralised web that empowers individuals and promotes innovation. Decentralisation, as embodied by cryptocurrencies and their underlying technologies, represents a powerful tool for human progress. It offers solutions to longstanding challenges in governance, privacy, and innovation. However, realizing this potential will require careful consideration of the technical, economic, and social implications of these systems.

As we navigate this transition, we must heed the words of anthropologist Margaret Mead: “Never doubt that a small group of thoughtful, committed citizens can change the world; indeed, it’s the only thing that ever has.” In the world of cryptocurrencies and decentralised technologies, every participant has the potential to contribute to shaping a more open, resilient, and equitable future.

Cryptocurrencies as Enablers of Scientific Advancement

The intersection of cryptocurrencies and scientific research represents a frontier ripe with potential for accelerating human knowledge and innovation. As we stand on the cusp of breakthroughs in fields like artificial intelligence, biotechnology, and quantum computing, the need for robust, flexible, and ethically sound funding mechanisms has never been more crucial.

Historian of science Thomas Kuhn posited that scientific revolutions occur when anomalies accumulate that can’t be explained by the existing paradigm. In a similar vein, cryptocurrencies and blockchain technology offer a revolutionary paradigm for funding and conducting scientific research, addressing longstanding issues in the current system. One of the most promising applications is in facilitating unstoppable research, particularly in controversial or cutting-edge fields. Consider the realm of AI-aided DNA editing, a field fraught with ethical considerations and regulatory hurdles. Traditional funding sources may shy away from such contentious areas, but cryptocurrency-based crowdfunding platforms could provide a decentralised alternative. This echoes the spirit of scientific freedom advocated by philosopher of science Paul Feyerabend, who argued against methodological monism in his work “Against Method.” The immutable and transparent nature of blockchain technology offers new possibilities for ensuring the integrity of scientific research. The replication crisis plaguing many scientific fields could be addressed through blockchain-based systems that record every step of the research process, from hypothesis formulation to data collection and analysis. This aligns with Karl Popper’s emphasis on falsifiability and the importance of reproducibility in scientific endeavors.

Cryptocurrencies also enable novel ways of incentivizing and recognizing scientific contributions. Decentralised autonomous organizations (DAOs) dedicated to scientific advancement could implement token-based systems for peer review, citation, and research impact. This could lead to a more meritocratic and efficient allocation of resources, addressing concerns raised by sociologist of science Robert K. Merton about the “Matthew Effect” in science, where eminent scientists often receive disproportionate credit.

The potential for borderless collaboration in science, facilitated by cryptocurrencies, cannot be overstated. In his book “The Structure of Scientific Revolutions,” Kuhn emphasized the role of scientific communities in shaping paradigms. Cryptocurrency networks could foster global scientific communities unrestricted by national boundaries or institutional affiliations, potentially accelerating the pace of scientific discovery. However, as we embrace these new possibilities, we must also grapple with their ethical implications. The anonymity offered by some cryptocurrencies, while beneficial for protecting researchers from persecution, could also be misused to fund unethical research. This echoes concerns raised by philosopher Hans Jonas in “The Imperative of Responsibility,” urging us to consider the long-term consequences of our technological capabilities. The decentralised ranking of scientists and research facilities enabled by blockchain technology could revolutionize how we evaluate scientific merit. However, we must be cautious not to create new forms of inequality or exclusion. As sociologist Pierre Bourdieu noted, systems of classification can reinforce existing power structures. The challenge lies in creating truly egalitarian systems that recognize diverse forms of scientific contribution. Cryptocurrencies and blockchain technology offer transformative potential for scientific advancement. They provide tools for unstoppable research, ensure transparency and reproducibility, enable global collaboration, and offer new models for funding and recognition. However, as we harness these technologies, we must remain vigilant to their ethical implications and potential unintended consequences.

As physicist Richard Feynman once said, “I think it’s much more interesting to live not knowing than to have answers which might be wrong.” In embracing cryptocurrencies as enablers of scientific advancement, we open ourselves to new questions and possibilities, driving forward the endless frontier of human knowledge.

The Psychology of Adoption

The journey of cryptocurrency adoption is as much a psychological phenomenon as it is a technological one. To understand the future of these digital assets, we must delve into the complex interplay of human cognition, behavior, and social dynamics that drive the acceptance of new technologies.

The concept of the “first-mover advantage,” which has benefited Bitcoin significantly, finds its roots in the psychological principle of anchoring, first described by psychologists Amos Tversky and Daniel Kahneman. This cognitive bias explains why Bitcoin, as the first widely recognized cryptocurrency, continues to dominate the market despite technical limitations. The challenge for newer, more technologically advanced cryptocurrencies lies in overcoming this psychological anchor. However, as Nobel laureate Herbert Simon pointed out in his work on bounded rationality, humans don’t always make decisions based on perfect information or pure logic. The adoption of cryptocurrencies is influenced by a myriad of factors, including social proof, loss aversion, and the endowment effect. These psychological principles, described by behavioral economists like Richard Thaler, help explain the volatile nature of cryptocurrency markets and the sometimes irrational exuberance or fear that drives them. The shift from abstract belief to rational evaluation of utility represents a crucial phase in the maturation of the cryptocurrency ecosystem. This transition echoes the diffusion of innovation theory proposed by Everett Rogers, which describes how new ideas and technologies spread through society. As cryptocurrencies move from early adopters to the early majority, we can expect a greater emphasis on practical applications and tangible benefits.

Education plays a pivotal role in this transition. As psychologist Jean Piaget noted, learning is not merely the acquisition of information, but the construction of mental models that allow us to understand and interact with the world. For cryptocurrencies to achieve widespread adoption, there needs to be a concerted effort to build these mental models in the general population, demystifying the technology and its potential applications. The concept of “mental accounting,” introduced by Richard Thaler, is particularly relevant in understanding how people perceive and use different forms of money. As cryptocurrencies become more prevalent, we may see a shift in how individuals categorize and value these digital assets compared to traditional currencies.

The adoption of cryptocurrencies taps into deeper psychological needs. The desire for financial sovereignty and distrust in traditional institutions, amplified in the aftermath of the 2008 financial crisis, has fueled interest in decentralised financial systems. This aligns with psychologist Abraham Maslow’s hierarchy of needs, particularly the needs for safety and self-actualization. The path to widespread adoption is not without psychological barriers. The complexity of the technology, concerns about security, and the fear of the unknown all present significant hurdles. Overcoming these will require not just technological solutions, but also careful consideration of user experience and psychology.

The role of narrative and storytelling in driving adoption cannot be overstated. As Yuval Noah Harari argues in “Sapiens,” humans are uniquely capable of believing in shared fictions that enable large-scale cooperation. The stories we tell about cryptocurrencies – whether as a hedge against inflation, a tool for financial inclusion, or a catalyst for technological innovation – will play a crucial role in shaping their adoption and use. As we look to the future, the success of cryptocurrencies will depend not just on their technical merits, but on their ability to align with human psychology and social dynamics. The challenge lies in creating systems that are not only technologically sound but also intuitive, trustworthy, and aligned with human values and needs. In the words of psychologist Kurt Lewin, “There is nothing so practical as a good theory.” As we continue to develop and refine cryptocurrencies, we must ensure that our understanding of human psychology informs their design and implementation. Only then can we hope to create digital assets that truly serve and empower humanity.

Future Perspectives

As we stand at the threshold of a new era, the potential evolution of cryptocurrency ecosystems presents both exciting possibilities and formidable challenges. To envision the future, we must synthesize our understanding of technology, economics, and human behavior, while remaining open to the unforeseen developments that often characterize paradigm shifts. The integration of cryptocurrencies into everyday life and governance is likely to accelerate, driven by advances in user interface design, scalability solutions, and regulatory frameworks. As economist W. Brian Arthur noted, technology often evolves through a process of combinatorial evolution, where existing components are recombined in novel ways. We may see cryptocurrencies merge with other emerging technologies such as artificial intelligence, the Internet of Things, and augmented reality, creating new forms of economic interaction and value creation. The concept of “programmable money,” enabled by smart contracts and decentralised finance (DeFi) protocols, could revolutionize how we think about and use currency. This aligns with the vision of cybernetics pioneer Norbert Wiener, who foresaw the profound impact of information technology on society. Cryptocurrencies could become the substrate for complex economic systems that automatically adjust to real-world conditions, potentially addressing issues like wealth inequality and resource allocation with unprecedented precision and fairness.

However, as philosopher Nick Bostrom warns in his work on existential risk, powerful technologies can also pose significant dangers if not carefully managed. The challenge for the cryptocurrency community will be to harness the potential of these technologies while mitigating risks such as systemic financial instability, privacy violations, or the exacerbation of existing social inequalities. The role of cryptocurrencies in shaping future governance models is particularly intriguing. Political scientist Robert Dahl’s criteria for democratic processes could be more fully realized through blockchain-based voting systems and decentralised autonomous organizations (DAOs). We may see the emergence of new forms of digital democracy that transcend traditional geographical and institutional boundaries. Moreover, the economic implications of widespread cryptocurrency adoption could be profound. Economist Thomas Piketty’s work on wealth concentration might need to be reevaluated in a world where decentralised finance provides broader access to investment opportunities and financial services. The deflationary nature of many cryptocurrencies could also challenge conventional monetary policy, echoing debates between Keynesian and Austrian schools of economic thought.

The environmental impact of cryptocurrencies, particularly energy-intensive proof-of-work systems, will need to be addressed. This challenge aligns with economist Herman Daly’s concept of a steady-state economy, emphasizing the need for sustainable economic systems. We may see a shift towards more energy-efficient consensus mechanisms and the integration of cryptocurrencies into renewable energy markets. As adoption grows, the intersection of cryptocurrencies with international relations and geopolitics will become increasingly significant. Political scientist Joseph Nye’s concept of “soft power” might need to be expanded to include “crypto power” – the ability of nations or non-state actors to influence global affairs through control or manipulation of cryptocurrency networks. Education will play a crucial role in shaping the future of cryptocurrencies. As philosopher and educator John Dewey argued, democracy requires an educated populace. Ensuring widespread understanding of cryptocurrency technology and its implications will be essential for fostering informed participation and preventing the creation of new forms of digital divide. Looking further ahead, the development of quantum computing poses both threats and opportunities for cryptocurrency systems. While it could potentially break current encryption methods, it might also enable new forms of cryptographic security and computational capability.

The future of cryptocurrencies is inextricably linked with the future of human society itself. As we navigate this uncharted territory, we must remain adaptable, ethical, and forward-thinking. In the words of futurist Alvin Toffler, “The illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn, and relearn.” Our ability to continuously evolve our understanding and application of cryptocurrency technologies will be key to harnessing their potential for the betterment of humanity.

Cryptocurrencies as Catalysts for Human Progress

In the tapestry of human advancement, cryptocurrencies are emerging as a vibrant thread, weaving together technology, economics, and social progress in unprecedented ways. Far from being mere digital tokens, these cryptographic assets are rapidly becoming the lifeblood of a new decentralised economy, one that promises to revolutionize how we incentivize and organize human activity on a global scale. Consider the realm of scientific research, traditionally hampered by centralized funding mechanisms and publication gatekeepers. The emergence of platforms like Molecules (https://www.molecules.exchange) is reshaping this landscape. By tokenizing early-stage drug discovery, Molecules allows researchers to raise funds directly from the public, bypassing traditional grant processes. As Dr. Paul Kohlhaas, the platform’s co-founder, explains, “Blockchain technology and tokenisation can align incentives between researchers, funders, and the public to accelerate drug discovery and reduce costs” (CoinDesk, 2020).

In the field of renewable energy, cryptocurrencies are powering innovative solutions to climate change. The SolarCoin Foundation rewards solar energy producers with cryptocurrency, creating a direct incentive for clean energy production. As Nick Gogerty, the founder of SolarCoin, states, “SolarCoin is designed to accelerate the global energy transition to a low carbon economy” (CleanTechnica, 2018). This model demonstrates how cryptocurrencies can align economic incentives with environmental goals, a feat traditional monetary systems have struggled to achieve. The potential of cryptocurrencies to drive financial inclusion is not just theoretical – it’s happening now. In Venezuela, where hyperinflation has devastated the traditional economy, cryptocurrencies have become a lifeline. Alejandro Machado, co-founder of the Open Money Initiative, reports, “Cryptocurrencies are helping Venezuelans preserve value and receive remittances from abroad” (Bloomberg, 2019). This real-world example illustrates how cryptocurrencies can provide economic stability in regions where traditional financial systems have failed. The decentralized finance (DeFi) movement, built primarily on the Ethereum blockchain, is reimagining financial services from the ground up. Platforms like Aave allow users to lend and borrow cryptocurrencies without intermediaries, democratising access to financial services. As Stani Kulechov, founder of Aave, puts it, “DeFi is bringing financial services to people who have been left out of the traditional banking system” (Forbes, 2021).

In the realm of digital identity, projects like Civic are using blockchain technology to create secure, self-sovereign identity systems. This has profound implications for privacy and data ownership. Vinny Lingham, Civic’s CEO, argues, “Blockchain-based identity solutions can give individuals control over their personal data while reducing identity theft and fraud” (TechCrunch, 2018). The gaming industry, too, is being transformed by cryptocurrencies. Games like Axie Infinity have created play-to-earn economies where players can earn real economic value through gameplay. As Gabby Dizon, co-founder of Yield Guild Games, notes, “Play-to-earn games are providing economic opportunities to people in developing countries, especially during the COVID-19 pandemic” (Coindesk, 2021). Even the art world is being revolutionised. The rise of Non-Fungible Tokens (NFTs) has created new avenues for artists to monetize their work directly. Beeple, the digital artist who sold an NFT for $69 million at Christie’s, states, “NFTs are the first time that digital artists can truly own and sell their work in the same way physical artists have been able to” (The Verge, 2021).

These examples illustrate a crucial point: cryptocurrencies are not just about creating new forms of money; they’re about reimagining how we incentivize and organize human activity. As Balaji Srinivasan, former CTO of Coinbase, argues, “Cryptocurrencies are to incentives what the internet was to information” (Twitter, 2021). It’s important to acknowledge the challenges. Issues of scalability, energy consumption, and regulatory compliance are real and need to be addressed. Vitalik Buterin, co-founder of Ethereum, acknowledges this, stating, “The challenge now is to scale blockchain technology to handle mainstream adoption while maintaining decentralisation and security” (IEEE Spectrum, 2021).

Despite these hurdles, the potential of cryptocurrencies to drive human progress is undeniable. By enabling truly decentralised services, fostering financial inclusion, and creating new economic models, cryptocurrencies are laying the groundwork for a more open, efficient, and equitable global economy. As we stand at this technological crossroads, it’s clear that cryptocurrencies are more than just a new asset class – they’re a fundamental reimagining of how we create and exchange value. In the words of Andreas Antonopoulos, a prominent blockchain educator, “Cryptocurrencies are not just money for the internet. They are the internet of money” (TEDx, 2016). The shift towards cryptocurrencies and the decentralised services they enable is not just a trend – it’s a paradigm shift in how we coordinate human efforts on a global scale. As we face the complex challenges of the 21st century, from climate change to wealth inequality, the borderless, programmable nature of cryptocurrencies may prove to be the very tool we need to unlock new solutions and propel humanity into a more prosperous and equitable future.

The Nexus of Freedom, Incentives, and Cryptocurrencies

Thesis: Cryptocurrencies are the only viable mechanism to sustainably incentivize the provision of freedom-oriented services in the digital age.

Underlying Assumptions:

- People inherently desire and require freedom-oriented services.

- These services include uncensorable social media, end-to-end encrypted communication, and applications immune to central control.

- Sustainable provision of these services requires effective incentive mechanisms.

“Freedom is not worth having if it does not include the freedom to make mistakes,” said Mahatma Gandhi. In our digital age, this freedom extends to our online interactions, communications, and the applications we use. The need for freedom-oriented services is not just a matter of preference, but a fundamental requirement for the preservation of human autonomy and dignity in the 21st century.

Let us examine each assumption in detail:

The desire for freedom-oriented services:

John Stuart Mill argued, “The only freedom which deserves the name is that of pursuing our own good in our own way.” In the digital realm, this translates to the need for platforms where individuals can express themselves without fear of censorship, communicate privately, and use applications that serve their interests rather than those of central authorities.

Evidence for this assumption is abundant. The mass exodus of users from WhatsApp to Signal in 2021 following privacy concerns, the rise of decentralised social media platforms like Mastodon, and the growing popularity of privacy-focused browsers like Brave all point to a clear demand for freedom-oriented digital services.

The nature of these services:

Uncensorable social media platforms ensure that “If freedom of speech is taken away, then dumb and silent we may be led, like sheep to the slaughter,” as George Washington warned. End-to-end encrypted communication protects the right to privacy, which Justice Louis Brandeis called “the most comprehensive of rights and the right most valued by civilised men.” Applications immune to central control embody Friedrich Hayek’s insight that “The more the state ‘plans’ the more difficult planning becomes for the individual.”

The need for effective incentive mechanisms:

Adam Smith’s observation that “It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest,” holds true for digital services as well. Sustainable provision of freedom-oriented services requires that service providers be adequately incentivized.

Now, let us examine why cryptocurrencies are the only viable mechanism to meet this need:

1. Censorship Resistance: Traditional financial systems are subject to censorship and control by central authorities. Cryptocurrencies, being decentralized, allow for the transfer of value without the risk of transaction censorship. As Satoshi Nakamoto, the creator of Bitcoin, stated, “With e-currency based on cryptographic proof, without the need to trust a third party middleman, money can be secure and transactions effortless.”

2. Borderless Nature: Freedom-oriented services often need to operate across national boundaries. Cryptocurrencies enable seamless cross-border transactions, unimpeded by the friction of traditional international money transfers. This aligns with Thomas Paine’s view that “My country is the world, and my religion is to do good.”

3. Programmability: Smart contracts on blockchain platforms allow for complex, automated incentive structures. This programmability enables the creation of decentralized autonomous organizations (DAOs) that can govern and incentivize freedom-oriented services without central control. As Nick Szabo, the pioneer of smart contracts, noted, “These contracts are more than just a way to replace middlemen and reduce costs. They’re a way to create new markets and entirely new types of assets.”

4. Micro-transactions: Many freedom-oriented services may require micro-payments that are uneconomical in traditional financial systems due to transaction fees. Cryptocurrencies, especially those optimized for micro-transactions, make these economically viable. This enables new business models, realizing Milton Friedman’s prediction that “The one thing that’s missing, but that will soon be developed, is a reliable e-cash.”

5. Alignment of Incentives: Cryptocurrencies often align the incentives of service providers, users, and token holders. This creates a stakeholder economy where all participants are motivated to contribute to the network’s success. This embodies John Nash’s concept of equilibrium in game theory, where each participant is making the best decision for himself while taking into account the decisions of others.

6. Privacy: Privacy coins provide a level of transaction privacy that is impossible with traditional financial systems. This is crucial for services where user privacy is paramount. As Edward Snowden said, “Arguing that you don’t care about the right to privacy because you have nothing to hide is no different than saying you don’t care about free speech because you have nothing to say.”

The provision of freedom-oriented services in the digital age is not just desirable, but essential for the preservation of human liberty. These services, by their very nature, require incentive mechanisms that are resistant to censorship, borderless, programmable, capable of micro-transactions, aligned with all stakeholders, and privacy-preserving. Cryptocurrencies, with their unique attributes, stand alone in their ability to meet all these requirements. As we navigate the challenges of the digital age, we must recognise that cryptocurrencies are not merely a new form of money, but a fundamental tool for preserving and extending human freedom. In the words of Aristotle, “The worst form of inequality is to try to make unequal things equal.” By providing a means to fairly and efficiently incentivise freedom-oriented services, cryptocurrencies are a powerful force for equality and liberty in the digital realm.

The Imperative of True Decentralization

“Whoever controls the media, controls the mind,” said Jim Morrison. In our digital age, this control extends beyond traditional media to our communication platforms and apps. The case of Signal, often touted as a paragon of secure messaging, serves as a stark reminder of the vulnerabilities inherent in centralized systems.

Signal’s requirement for users to provide a mobile phone number is more than a mere inconvenience; it’s a potential security backdoor. As security expert Bruce Schneier notes, “Security is only as strong as the weakest link.” In Signal’s case, this weak link is the very foundation of user identity within the system.

To understand why this is problematic, we must examine how operating systems and APIs function:

Operating System Level

Modern operating systems act as intermediaries between hardware and software. They provide APIs (Application Programming Interfaces) that applications use to interact with the system. As computer scientist Andrew S. Tanenbaum explains, “The operating system is an illusionist: it creates the illusion that the program has the entire computer to itself.”

Input Mechanisms

Before any data reaches an application like Signal, it passes through several layers:

– Physical input (keyboard, touchscreen)

– Device drivers

– Operating system input handlers

– Virtual keyboard (on mobile devices)

Each of these layers presents an opportunity for interception. As cryptographer Phil Zimmermann warns, “If you have to type your passphrase into a keyboard, it may already be too late.”

API Vulnerabilities

APIs, while essential for functionality, can also be exploited. The infamous Pegasus spyware, for instance, utilized zero-day exploits in popular messaging apps to intercept communications before encryption.

The resources poured into counter-intelligence by state agencies are staggering. The U.S. National Security Agency’s budget alone was reported to be $10.8 billion in 2013, according to documents leaked by Edward Snowden. This vast funding enables the development and acquisition of sophisticated surveillance tools and zero-day exploits.

The sudden appearance and subsequent takedown of truly secure platforms often follow a suspicious pattern. EuroHat, a promising end-to-end encrypted application, saw its developers implicated in drug-related charges shortly after launch. This echoes the words of activist Cory Doctorow: “The first step in fighting back against surveillance is to make it so ubiquitous that it becomes invisible.”

It’s crucial to understand that true cryptography and mathematics have no inherent need for mobile phone numbers. The requirement to link secure communication to a phone number is an artificial constraint, likely imposed to facilitate user tracking. As cryptographer Matthew Green points out, “The security of your messaging system should never depend on the security of your phone number.”

In contrast, truly decentralized platforms offer several advantages:

- No Single Point of Failure: As Ethereum co-founder Vitalik Buterin explains, “The logical extreme of decentralization is having every single person run their own node.”

- Resistance to Coercion: Decentralized systems make it nearly impossible for any single entity to be coerced into compromising user data.

- Censorship Resistance: With no central authority controlling the network, it becomes extremely difficult to censor or shut down the platform.

- Privacy by Design: Truly decentralized systems can be built with privacy as a fundamental feature, not an afterthought.

The philosopher Jürgen Habermas argued for the importance of the public sphere – a space for open dialogue free from state or corporate control. In our digital age, truly decentralized platforms are essential for preserving this public sphere. To achieve this, we must move beyond centralized systems that claim to offer security while introducing potential backdoors. Instead, we need to embrace and develop truly decentralized platforms that leverage the power of blockchain technology and cryptocurrencies. As cypherpunk Eric Hughes wrote in his manifesto, “We must defend our own privacy if we expect to have any. We must come together and create systems which allow anonymous transactions to take place.”

The pursuit of freedom-oriented platforms necessitates true decentralization. Centralized systems, no matter how well-intentioned, invariably introduce vulnerabilities and potential points of compromise. As we move forward in the digital age, it is imperative that we critically examine the tools we use for communication and collaboration, always striving for systems that truly embody the principles of privacy, security, and freedom.

The Decentralized Operating System – A New Paradigm for Digital Freedom

“The most profound technologies are those that disappear. They weave themselves into the fabric of everyday life until they are indistinguishable from it.” – Mark Weiser. The concept of a decentralised operating system (DOS) represents a paradigm shift in how we interact with technology and access digital services. To understand its significance, we must first consider the historical context of our current digital landscape.

When tech giants like Microsoft, Google, and Facebook were in their infancy, the concept of cryptocurrency didn’t exist. As philosopher and media theorist Marshall McLuhan observed, “We shape our tools, and thereafter our tools shape us.” These companies shaped their business models around the tools available at the time, primarily relying on advertising and the monetisation of user data. However, as cryptographer and legal scholar Nick Szabo notes, “The internet is missing a layer.” This missing layer is a native value transfer protocol, which cryptocurrencies now provide. With this new tool at our disposal, we can reshape our digital environment to align more closely with principles of privacy, security, and individual autonomy.

A decentralised operating system would serve as the foundation for this new digital ecosystem. Here’s how it could function:

1. Decentralised Identity

Instead of relying on centralised authorities for identity verification, a DOS could implement self-sovereign identity systems. As Christopher Allen, a pioneer in this field, explains, “The user must be central to the administration of identity.”

2. Native Value Transfer:

Cryptocurrencies would be integrated at the OS level, allowing for seamless, low-friction transactions. This aligns with economist Friedrich Hayek’s vision of competing private currencies.

3. Decentralized Storage and Computation:

Leveraging distributed systems like IPFS for storage and projects like Golem for computation, a DOS could offer robust, censorship-resistant alternatives to centralized cloud services.

4. Open-Source Development:

Following the philosophy of Richard Stallman, who said, “Free software is a matter of liberty, not price,” a DOS or at least a significant portion of its components would be open-source, allowing for community-driven development and scrutiny.

5. Privacy-Preserving APIs:

The DOS would provide APIs that allow developers to build applications without compromising user privacy. As security expert Bruce Schneier states, “Privacy is an inherent human right, and a requirement for maintaining the human condition with dignity and respect.”

The advantages of such a system are manifold:

1. Aligned Incentives:

Users could directly compensate service providers for the value they receive, eliminating the need for invasive advertising or data harvesting. This creates a more honest and transparent digital economy.

2. Enhanced Privacy:

With privacy built into the core of the system, users would have greater control over their personal information. As Edward Snowden said, “Arguing that you don’t care about the right to privacy because you have nothing to hide is no different than saying you don’t care about free speech because you have nothing to say.”

3. Resistance to Censorship:

A decentralised system would be inherently resistant to censorship and control by any single entity. This embodies John Gilmore’s famous quote, “The Net interprets censorship as damage and routes around it.”

4. Innovation Catalyst:

By providing a standardised, decentralised platform, a DOS would lower the barrier to entry for developers creating new decentralized applications. This could lead to a Cambrian explosion of innovation in the digital space.

5. User Empowerment:

Users would have greater control over their digital lives, from their data to their digital assets. This aligns with the cypherpunk ethos, as expressed by Eric Hughes: “We must defend our own privacy if we expect to have any.”

The development of a decentralised operating system is not without challenges. Issues of scalability, user experience, and interoperability with existing systems must be addressed. However, as computer scientist Alan Kay said, “The best way to predict the future is to invent it.” By providing a foundation for truly decentralised services and applications, a DOS could become the center of a new, more equitable digital world. It would allow developers to build and deliver decentralised services efficiently, with APIs designed for privacy and security from the ground up. The concept of a decentralised operating system represents a crucial step in the evolution of our digital infrastructure. It offers a way to realign the incentives of our digital economy, putting user privacy and autonomy at the forefront. As we stand at this technological crossroads, we have the opportunity to shape a digital future that respects individual liberty and fosters innovation.

As philosopher Jean-Paul Sartre said, “Freedom is what you do with what’s been done to you.” In the context of our digital lives, a decentralized operating system could be the tool that allows us to reclaim our freedom in the face of increasing digital surveillance and control. It’s not just a technological solution, but a philosophical stance on the future of human interaction in the digital age.

Final Words

As we draw this exploration to a close, we find ourselves standing at a fascinating juncture in human history. The Chinese curse (or blessing), “May you live in interesting times,” has never felt more apt. The world of cryptocurrencies embodies this sentiment, presenting a landscape rife with contradictions, rapid developments, and profound implications for our future.

On one hand, we witness large, multi-billion dollar investment funds publicly expressing skepticism about cryptocurrencies. Their caution echoes the resistance often faced by paradigm-shifting technologies throughout history. Yet, on the other hand, the proliferation of USDT ATMs in cities across the globe tells a different story. These machines, offering local currency withdrawals at rates that undercut traditional currency exchanges, represent a quiet revolution in how people interact with digital assets in their daily lives. This dichotomy between public stance and practical adoption mirrors the complex relationship society often has with transformative technologies. As science fiction author William Gibson famously said, “The future is already here — it’s just not very evenly distributed.” The truth, as is often the case, lies somewhere beneath the surface. While public discourse may still be catching up, the underlying technology driving cryptocurrencies continues to evolve and find real-world applications. The needs that drive technological progress – for financial inclusion, for secure and efficient value transfer, for decentralised governance – are real and pressing. As we’ve explored throughout this article, cryptocurrencies represent more than just a new form of money. They are the vanguard of a new way of thinking about value, trust, and human cooperation. From enabling scientific advancement to reshaping our concepts of governance, the potential applications of this technology are vast and varied.

Yet, we must remain clear-eyed about the challenges ahead. The environmental concerns, regulatory hurdles, and issues of scalability and user adoption are not trivial obstacles. They will require innovative solutions and thoughtful engagement from technologists, policymakers, and citizens alike. As we look to the future, it’s crucial to connect the dots between the various threads we’ve explored – the evolution of value, the intersection of technology and economics, the psychology of adoption, and the potential for human progress. Cryptocurrencies and blockchain technology offer us tools to address some of humanity’s most pressing challenges, from wealth inequality to climate change to the protection of individual privacy and freedom. In the words of anthropologist Margaret Mead, “Never doubt that a small group of thoughtful, committed citizens can change the world; indeed, it’s the only thing that ever has.” The cryptocurrency community, with its ethos of decentralisation and empowerment, embodies this spirit of change.

As we navigate these interesting times, let us approach the future of cryptocurrencies with a balance of enthusiasm and critical thinking. The technology is real, the progress is tangible, and the needs driving this innovation are genuine. Our task now is to harness this potential responsibly and equitably, ensuring that the benefits of this digital revolution are accessible to all. Now, while the surface-level discourse around cryptocurrencies may be mixed, the undercurrents of change are strong and steady. By connecting the dots between technological innovation, economic theory, and human needs, we can begin to glimpse the outlines of a future where digital assets play a central role in shaping a more open, efficient, and equitable world. The journey ahead is complex and challenging, but it is also filled with unprecedented opportunities for human progress. Indeed, we live in interesting times – and the most fascinating chapters of the cryptocurrency story are yet to be written.